From monoliths like XVideos to Pornhub, tube sites have upended the adult industry ever since they first emerged onto the scene in 2006. This was right around the time of The Great Recession, as the U.S. housing bubble burst and triggered a global financial crisis.

Suddenly, there was a surge of free content and users with less money than before to spend on premium adult entertainment. This naturally led to the decimation of traditional paysites and smaller production studios, whose content flooded the internet without authorization on file-sharing platforms. Not to mention, DVD sales had already begun descending as digital media was entering a new era of video consumption fueled by the likes of Netflix and YouTube.

And yet, harsh as it may sound, much of this bucking was nothing new. Recession or not, media delivery and consumer behavior had already begun shifting dramatically a decade prior. The movie, television and music industries had each survived their own cataclysmic transformations, and just like adult, it all centered on two accelerating market forces: faster internet and people’s natural desire for all things free.

In many ways, you could say Napster was the catalyst. When scrappy teenage programmers Shawn Fanning and Sean Parker pioneered the peer-to-peer (P2P) software on June 1, 1999, created to enable audio file-sharing in the form of MP3s, they unleashed a ripple effect that would change the internet forever.

And while they eventually ran into trouble from irate music moguls and were successfully sued by the Recording Industry Association of America — despite having developed a solution that blocked 99% of identified infringing material by the time judgment was delivered — a host of other P2P software had sprung up, such as LimeWire, Kazaa, BitTorrent and scores more.

The match was lit and the trend was set. Legislation would be tested, technology would exponentially advance and markets would quake by the time tubes arrived.

To chronicle the history of adult tubes, we sat down with several industry stalwarts who witnessed first-hand the growing pains that this new breed of sites ushered in.

Reflecting on the internet’s shift in the ‘90s and 2000s towards rampant content-sharing and user-generated media, we examined the ways in which tube sites were a market inevitability. We also took a deep dive into web analytics provider SimilarWeb to gauge the enormity of today’s tube operators.

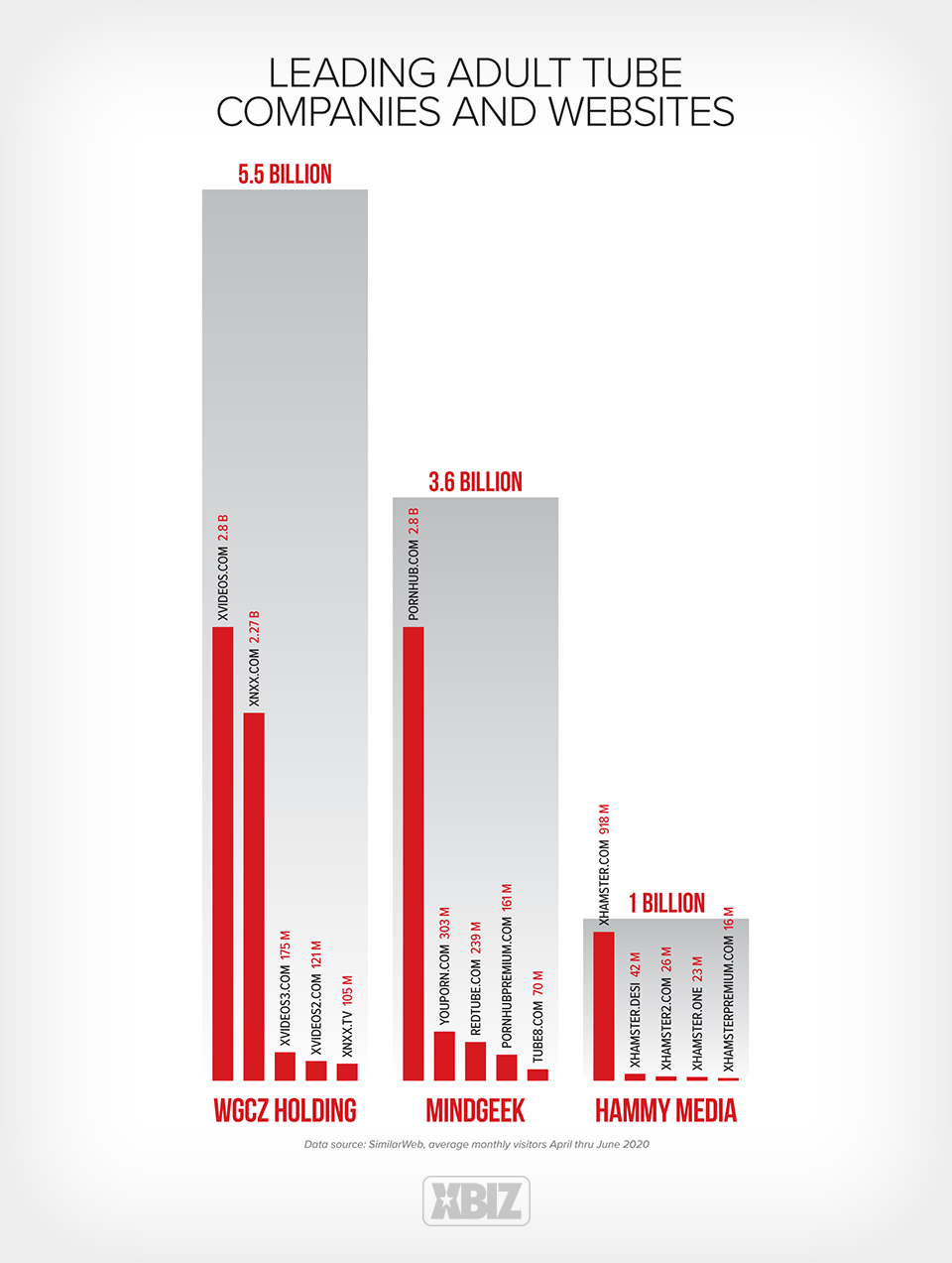

The short and the quick of it is, that despite mainstream media’s obsession with Pornhub parent company MindGeek as some “monopoly,” the true king of tubes is, in fact, XVideos parent company WGCZ Holding, commanding more traffic than its two biggest competitors combined: MindGeek and Hammy Media, parent company of xHamster.

We’ll break down the numbers later in this report, with total monthly visits that are in the billions, highlighting the powerhouse tubes under each company’s umbrella.

The Wild West of a New Frontier

How did the adult biz go from the gold rush of the ‘90s to today’s new (and starkly different) golden age of talent-driven and democratized marketplace?

How did business shift from legions of affiliate webmasters to a worldwide community of independent performers and from a crowded field of production houses to mega-corporations acquiring famed studio brands?

Jason Tucker, managing director of Battleship Stance, a copyright management, enforcement and legal services company whose clients include prominent industry players, has enjoyed a bird’s-eye view of the adult web.

“With increased delivery speed came an increased demand for higher quality content,” he remarked. “In the early days, it took minutes to load an image. Then, came ‘JPEG push,’ a technique that simulated a video experience (like a flip book of images). With reduced latency and reduction of packet loss, we welcomed the opportunity to deliver video. Then, it was a quick jump to the consumer demanding higher quality video.

“During this same period, we saw Napster and similar software offer a more seamless exchange for content sharing,” he continued. “With any jump in technology, opportunity opens up. For the adult business that growth was thumbnail gallery post (TGP) sites and then movie gallery post sites. For a short time, there was the concept of MPG2, an attempt to rein in what was inevitable: full-length free movies.”

Not too long after MPG2 became a standard, Tucker noted, “It was at this point that sites started popping up offering pirated full-length movies. For the first time, consumers and enterprising tech-savvy actors could seek out, acquire, share and profit from stolen content. Once the price of bandwidth dropped, there was no stopping the flood.”

Indeed, the amount of subscribers harnessing broadband speeds jumped 50% from 2000 to 2001 and nearly another 50% by 2003, with more than half of the U.S. plugged in by 2010; this, in turn, drove consumers’ insatiable appetite for on-demand digital media content.

As attorney Larry Walters of Walters Law Group noted, he saw broadband as the gateway to even faster changes in the industry. “As Web 2.0 developed in the late ‘90s, the rise of tube sites was inevitable,” he underscored. “Much of the early online porn was shared by users through newsgroups and forums, but the implementation of broadband internet access paved the way for tube sites to dominate the adult market.”

Growing just as rapidly as internet speeds, was the rate at which users were downloading content and uploading it elsewhere. And just as with Napster, copyright infringement claims against online piracy soon followed en masse.

“As one of the first to tackle online piracy, we hit operators from multiple directions,” Tucker shared. “Once the operators learned more about the law, they started creating users or building their sites to look like they had actual users. Those early ‘actual users’ were simply employees and teams uploading for profit. The early UGC (user-generated content) tube sites had to educate consumers on their existence and that took a little time and slowed initial growth.

“At the peak of that early adoption, an old friend, standing on the steps of a hotel in Florida, shared his vision,” Tucker reminisced. “He had already established himself in the adult business as a smart programmer. His software served as the backend for about 70-80% of all membership websites. His [new] model was the inverse of the paysite membership funnel the rest of the industry focused on; his model was to offer a network of sites that had the best content viewable, with ease, to the user, monetized by advertising and upsells. Today, that vision has grown into one of the largest adult companies on the planet. Was it inevitable? Of course.”

Another long-time industry veteran, Colin Rowntree, CEO of Wasteland.com, has seen it all and survived the turbulent waters with his venerable BDSM brand. He offered his own perspective on the history of tubes.

“On a day which will live in infamy, on August 26, 2006 the first porn tube was launched: YouPorn.com,” he said. “YouTube had, by then, legally locked down the DMCA safe harbor exploits for user-uploaded content and YouPorn launched with an initial batch ripped from DVDs.”

The Digital Millennium Copyright Act (DMCA) is essentially an anti-piracy statute which forces service providers to take down infringing content once they’ve received formal notice of its existence on their site. The “safe harbor” element basically shields them from immediate consequences, so long as they remove the material once they’ve been notified.

“This opened up the floodgates for user uploads of clips which were intended to increase user loyalty and self-promotion,” Rowntree continued. “Some were self-produced homemade clips by kinky folks, but mostly were stolen by internet users from paysite membership sites to build their own user public video libraries. The horses were then out of the barn and by 2008, the rise of the tubes was in full effect and severely damaged the studios and paysite model on the internet.”

He also shared how in 2010, Pink Visual, then a leading paysite and content production company, “did major litigation and nearly took down the safe harbor assurance by filing a $6.75 million complaint against Mansef Productions (owners of Pornhub and other major tubes at the time), but ultimately stopped further action after getting an out of court settlement, leaving a clear path ahead for all tubes that were quickly growing in popularity to completely dominate.”

Also harkening back to those transformative years, when tube sites hadn’t yet been reined in by mega corporations, Grooby.com CEO Steven Grooby recalled, “Websites were at their peak in the late ‘90s and early 2000s, with lots of ‘mom and pop’ operations and some of the largest brands still running today, finding their feet … but what is inevitable, is that in any industry, someone will look at the hard work of others and see how they can profit off it, without putting the investment or the work in.

“There was plenty of piracy around at the time, with fake websites and newsgroups, but much of that was fan-based,” he said. “The tube sites of those days were parasites that were able to use the DMCA to their own advantage and create their own business model.”

The mayhem brought about by both rogue operators and more corporate disruptors, morphed the industry’s landscape forevermore.

Evolve or Fall by the Wayside

Not everything was doom and gloom, however, because the same way the music, movie and television industries had to evolve or go out of business, adult industry players forcibly adapted to the new landscape.

Battleship Stance’s Jason Tucker reflected, “To withstand the initial disruption of tube sites, it took accepting a new normal and identifying ways to vertically integrate into that model. It also took time to educate tube sites that if they wished to operate, they would have to do so by following intellectual property law or be subject to a civil action in courts around the world.

“Tubes were a disruptor,” he added. “They were innovative. Companies introduced hybrids in an attempt to compete. AEBN created a site with extended clips that upsold to VOD and partner membership sites. We attempted Digital Rights Management (DRM) technology and other key-based systems.”

Tucker underlined that none of those countermoves, pivots and fleet-footed flourishes proved a match for “free full-length movies on an open World Wide Web.” And once major tube sites blossomed into full-fledged businesses, opportunity knocked for those who had been knocked off course. Deals awaited those who risked reaching across the aisle, despite potential backlash from industry peers.

“We very quietly were early content partners with tubes,” Rowntree confessed. “Quietly, because if we publicly disclosed that we were doing this, an angry mob of webmasters would attack on the boards calling us traitors.”

Those who resisted, did so tenaciously and without compromise, unwilling to negotiate with what they viewed as a black and white matter. Giving up a cut of the action was out of the question.

“Many attempted to hold on as best as they could,” Tucker said. “Ultimately, it took desirable niche-specific content and studios’ willingness to take a loss on some content, to profit over the long-term from a percentage of ad revenue, memberships and other ancillary deals.”

As one of the longest-running paysite operators, with more than two decades under his wing, Steven Grooby remembered how withstanding the disruption took “a lot of time, a lot of anger and a lot of money.”

To this day, he tussles with the balance between working with tubes and issuing takedown notices. “For 15 years, we’ve had to spend resources every day, going onto tube sites and DMCA-ing the content.”

“Many ‘mom and pop’ brands simply couldn’t compete with their updates being pirated within hours of release, and that’s why we saw a much duller internet until the clip sites came out,” he said. “For a brand like Grooby, we have content that is fairly unique and there was a demand for it on the tube sites.

“By doing as much as we could to keep it off the sites, while also providing a better experience and value for money for the customer on our own sites, we managed to ride that out,” Grooby explained. “Many brands couldn’t.”

Attorney Larry Walters concurred, remembering that content producers were “hit hard and caught off guard” by the upending of business models, while the more unscrupulous tube operators were “viewed as the enemy of content producers, as pirated content became widely available on the sites.”

“Many accused the operators of being complicit with the infringing uploaders, and there may be some evidence to support that in specific cases,” he said, echoing Tucker’s account of rogue players using their own employees to fake “user uploads.”

“Several high-profile lawsuits were filed in the early days against the tube sites,” Walters said. “It was copyrights versus DMCA safe harbor. These cases showed the uncertainty of all litigation as some won, some lost and some settled.”

Yet it ultimately became clear, in his estimation, that the tubes controlled the traffic and that therefore, content producers needed to figure out a means of coexisting while still turning a profit.

“Some large tube operators acquired production studios and demonstrated how the two could combine efforts to drive sales,” Walters said. “Independent studios recognized that tubes could serve as promotional vehicles for content sales.”

Eventually, even the more resistant paysites came to realize how working with tubes offered certain advantages. After all, tube sites were unrivaled in terms of audience reach, funneling targeted traffic to their premium destinations.

Tucker explained, “At the core, tube sites present an opportunity that is Darwinian in nature. Tube sites made it clear that branding matters, to an industry which had become complacent. Tube sites allow premium content sites the opportunity to quickly market and test their products, for free, to large audiences. If the product is desirable and stands out, premium sites can monetize the experience with tube operators. In between that simple model are additional opportunities through good customer service and add-on services.”

This shift to harnessing potent marketing, taking the time to polish and fine-tune content and promotional offers, would prove to be a winning formula for both tubes and content-based businesses gravitating towards their orbit.

“It’s a volume business,” Tucker pointed out matter-of-factly. “Free content that entices users to want more can be turned into a paid membership. This is harder than it sounds, because of variables such as location, price, amount of additional content, other offerings and customer experience.”

Speaking from the experience of a webmaster-producer, Colin Rowntree of Wasteland shared that his company focused on two methods for driving sales: “Increased quality of our paysites and exploiting the tubes to brand Wasteland.com and attract type-in traffic.

“In those days, video quality on tubes was simply deplorable, so we presented our tour and member area videos in full HD 16:9 aspect ratio and provided the aesthetic of a private screening at a Hollywood studio VIP club,” Rowntree offered. In his eyes, increased quality was the simple part, since tube sites had inferior visual fidelity at the time.

Not against a bit of tactical ingenuity, Rowntree twisted the new ruleset tubes had forced upon the market. “Exploiting the tubes from within their platforms was always a cat and mouse game, but the most reliable technique we used to drive type-in traffic was to implant watermark ‘floaters’ at random moments in different areas of each video we uploaded,” he revealed.

“At that time, all tubes forbade watermarks of any kind and had automated detection of such for rejection, so our system of placing Wasteland.com on videos for three to five seconds at multiple random spots on each video in different quadrants, by and large fooled the tubes and a surprising amount of well-converting traffic came from users typing in our domain name,” Rowntree explained. “The tubes then became simply another source of branding and traffic for us.”

This bit of roguish “fight fire with fire” went on for a few years until the tube sites launched formal content partner programs. They sought to entice studios with a dedicated content channel, offering banner placements under the videos they uploaded, which would lead to their affiliate program and track revshare sales.

He then quipped, “Hardly fair, as the videos were studio property and we did all the heavy lifting for editing, uploading and keyword tagging, but better than a sharp stick in the eye, and it was at least something.”

And while tubes did their own bit of evolution to synergize with the market, opening the door for creative producers whose unique style could prove a boon to the content-hungry platforms, most of them did not.

Hence, as Grooby bluntly stated, “Let’s face it, there are hundreds of tube sites, but you can count on one hand the ones that are useful and make you money.”

It’s worth noting that partnering with tubes as a niche content creator has its own nuanced advantages. Given the stigma attached to certain content genres, this has shaped its fans — both the openly enthusiastic and the secret admirers — in a way that makes them unique prospects.

“There are fans of trans porn who, for personal reasons, will never join a trans porn site for fear of being ‘caught’ and having a label attached to them,” he continued. “These same people can go to a major tube site, pay a premium, and in the event of being found out, have the mitigation that they were surfing a general porn site.

“So, we can monetize those who would never join [our site] because of their perceived shame of being caught,” Grooby said. “For our company, with a strong brand, the tube sites don’t offer a much larger/wider reach, just the ability to make some income from those unable or unwilling to subscribe to us directly.”

For while tube traffic is massive in size, not all eyeballs lead to a good return on investment. “Those surfing tube sites generally aren’t those who pay for porn, but the sheer scale of numbers means you will have some hits,” assessed Grooby. “Maybe it’s just reminding a surfer of your brand or site, or getting a new girl’s face out there, but with social media becoming harder to market on, and diminishing affiliates, there are opportunities to have people put their eyes back onto your latest content, and perhaps bring them back to rejoin sooner rather than later.”

This oversaturation in general, of increasingly savvy users whose media consumption habits are more discerning than ever, means that finding good traffic is a hunt.

“We are very restrictive on the amount and length of the content we allow out, with only two affiliates allowed to upload a maximum of six minutes per scene,” Grooby said.

Giving too much, he surmises, leads users to get their fill and not pay up, while teasing too briefly fails to lure them in. By limiting the length of clips and the more explicit segments, studio operators can walk that fine line between a compelling lure and a free taste.

As for Walters, despite the fact that the lion’s share of tube site visitors are drawn to free content, he believes there’s plenty of business to be gained through a strategic partnership.

“While it took some time for the established adult industry to get used to the new tube site players, most learned to work together,” he said. “The tubes became more sensitive to the intellectual property rights of the content creators, and developed ways to tamp down on piracy.”

Harnessing the Disruption

Hindsight being 20-20, there are key lessons to be learned from the rise of tube sites. Because if ever there was a time to be ultra-savvy, to explore new business models and engage consumers with unique offerings, it’s during this era of unprecedented evolution.

As we’ve reported in the past few issues, there have been far-reaching changes; whether it’s an uptick in brands partnering with talent to drive sales or performers leveraging SFW platforms to broaden their reach, there have never been more ways to monetize adult entertainment.

And when it comes to monetizing the modern day consumer, Tucker believes, “High-quality, high-definition, well thought-out, niche and story-driven content and branded marketing material is a must to stand out in a crowded field. Analyzing consumer behavior and displaying content to a specific audience based on that data is a must.”

As for Rowntree, he expressed that for him, the biggest learning lesson was twofold. “First, innovation is the key to survival when a disrupter as huge as the tubes enters the marketplace,” he said. “In the case of the tubes, our innovation focused on increasing video quality and advancing our content delivery platform to be all of the things that the tubes were not at that time: a highly-curated ‘concierge experience’ for paying members.

“Secondly, fear and anger at change and unwillingness to adapt can mean death to any online business,” he elaborated, pointing out how many of those who criticized “traitors” for joining forces with tubes did not last.

“Many of those companies went out of business within a few years by resisting to adapt to the reality of the tubes and find ways to co-exist with and profit from them,” Rowntree said. “As much as I tire of this overused phrase, I’ll say it here: adapt or die.”

Even Grooby, who does not mince words when it comes to doing business alongside tubes, came to the realization, “Never say never.”

He elaborated, “We’re very happy with the income we make from both Pornhub Premium and xHamster Gold on older content we show.”

It’s a two-way street now, with tubes having deeply embedded themselves within the infrastructure of online adult. And when juggling intellectual property rights, even disruptors learn to play along with the creative lifeblood of the business.

“The internet is ever-changing,” said Walters. “You can never get comfortable with the way things work. There will always be new, disruptive technology and innovation around the corner. The law always lags behind technology, so the industry must work to resolve these disruptions using creativity while respecting intellectual property rights of content creators.”

An astute point, to be sure, given that legislation and court decisions often must contend with newly introduced nuances in tech and business models that push the envelope.

Casting their eyes from the past and present into the future, Walters and Tucker opined on how tubes sites might be impacted by changes in consumer demand and potential government regulations.

“Individual content creators are gaining more control over their businesses,” Walters said. “While there will always be an appetite for professionally produced studio content, technology has allowed performers to build their businesses without much middleman support. Consumer demand is turning towards individual relationships with content creators instead of studio-branded content. Tubes will be expected to develop a more one-on-one relationship with the performers.”

On a similar wavelength, Tucker noted, “The adult business is no longer about a Coke or a Pepsi, with generic visuals of sexual intercourse. The internet has allowed people to educate themselves on their own fetishes and provided a method to feed that fetish. Users land on a site to fill a specific need. Consumers want more personalized experiences. They want a true customer-focused experience. Tube sites that use data and new technology to deliver an enhanced experience simply garner more views.”

Sage words, given the success of camming, clips and premium social media platforms, as well as the freedom stars now enjoy with unprecedented independence and loyal fans who follow them wherever they go.

And for leading tubes looking to up their game, Tucker advised, “Content was once the product. Today, branded tube sites are the product. Consumers know the top tubes by name. The content on those sites simply help to deliver a programmed experience. If the personalization stays in line with or exceeds expectations, then tubes have no concern of user exodus.”

Essentially, he advises tube operators to customize, target and serve ever-changing appetites. They should deliver what the consumer craves, with minimal fuss and user clicks, while enticing them with premium offers.

As far as what could disrupt tubes themselves, Tucker said, “The threat to the tube model and the World Wide Web at large is governmental overreach seen in the EARN IT Act and a desired revision of Section 230 of the Communications Decency Act (CDA).”

Sizing up ‘The Big Three’

While official statistics can’t be drawn upon when it comes to measuring adult website traffic, internet analytics sources like SimilarWeb reveal interesting data: chief among them, the steep dropoff between top tube sites and their lower-ranked counterparts.

Within the umbrella of “the big three” — WGCZ Holding, MindGeek and Hammy Media — there are dozens of tube offshoots that are statistically insignificant when stacked against their biggest sister sites. So, rather than break down every tube site on the list, we zeroed in on each company’s top five properties.

Our analysis focused on their monthly visits from April through June, averaged over three months. To help put their stats into perspective, we tallied the overall monthly visitor count for the top 100 adult sites on SimilarWeb (including non-tube destinations): it totaled 16 billion.

Looking at the highest-ranked tubes, XVideos and Pornhub duke it out for the No. 1 spot with a whopping 2.8 billion monthly visits each. Some months, one is slightly higher than the other, but they’re mostly neck and neck. When you bring in the third highest-ranked tube, XNXX (under WGCZ), it boasts around 2.27 billion, while in fourth position is Hammy Media’s xHamster with about 918 million.

Adding to WGCZ’s portfolio heft, XVideos2.com and XVideos3.com are also frequently found in the top 10, with 121 million and 175 million respectively. And when you add in a couple hundred million to the stack from various offshoots like XNXX.xxx, XNXX.net and so forth, the grand total arrives at roughly 5.5 billion average monthly visits for WGCZ.

On the MindGeek front, Pornhub is joined in the top 10 by sister sites YouPorn and RedTube, which command 303 and 239 million visits respectively. Adding in lower-ranked sites like PornhubPremium.com with 161 million and Tube8.com with 70 million brings MindGeek’s monthly audience to 3.6 billion.

Even if you add up traffic from all of MindGeek’s non-tube properties (like Brazzers, Digital Playground, etc.), it doesn’t shift the grand total by much more than 30 or 50 million. This is likewise the case with WGCZ’s own studio sites such as Bang Bros, DDF Network, Legal Porno and Private Media Group.

Hammy Media, the third-biggest tube operator, garners the bulk of its traffic from fourth-ranked xHamster.com. The next biggest property in its portfolio is xHamster.desi with 48 million visits. Factoring in traffic from xHamster2.com, xHamster.one and xHamsterPremium.com, the grand total for Hammy Media is roughly 1 billion.

And thus, in the final tally, WGCZ Holding stands at 5.5 billion cumulatively, MindGeek at 3.6 billion and Hammy Media at 1 billion.

No doubt, the massive influence of tubes continues, and their disruptive impact over the years is proof that the adult industry is one of the most adaptive in the world. And while nobody can predict the next big thing, until then, businesses have to be innovative and attuned to shifting cultural winds. For as audiences become increasingly drawn to personality-driven entertainment, tubes are bound to shed some of their algorithmic skin, embracing demand for more authenticity.